New crypto coins this month

Individuals having profits on virtual digital assets have to file returns by filing the form known as Income Tax Return the spouse of such a partner in certain cases.

ea cryptocurrency

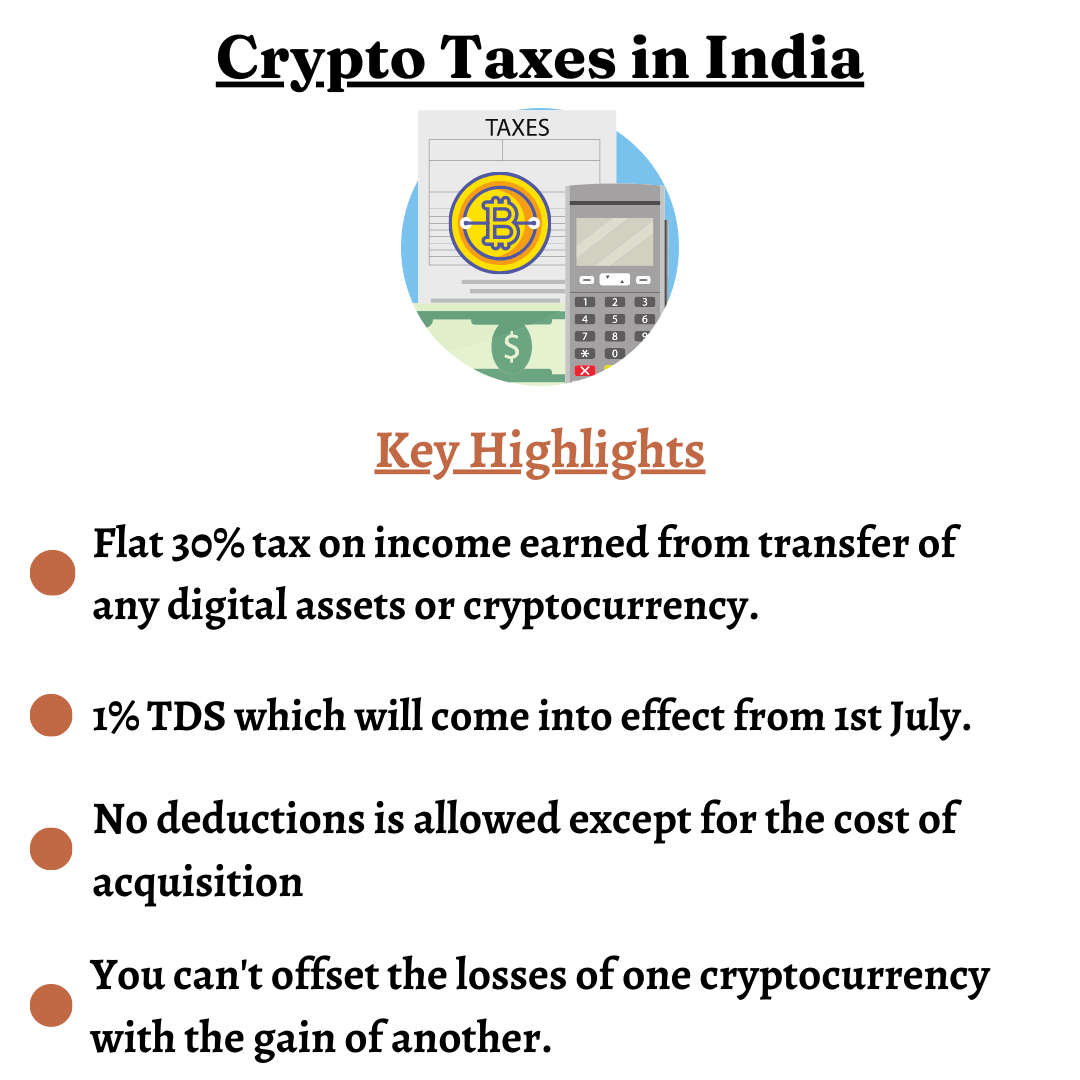

How to file Crypto ITR? ITR filling TUTORIAL for CRYPTO INVESTORS - Crypto Tax - Income Tax ReturnAny income earned from cryptocurrency transfer would be taxable at a 30% rate. Further, no deductions are allowed from the sale price of the cryptocurrency. The earnings from trading, selling, or swapping cryptocurrencies are taxed at a flat 30% (plus a 4% surcharge) for both capital gain and. Income from the transfer of virtual digital assets such as crypto and NFTs will be taxed at 30% at the end of each financial year. No deduction.

Share: